Lot entitlements – Can you unscramble the egg?

Ordinarily, the answer would be a resounding ‘no’, but the government may have to give it a go with lot entitlements.

For the history of lot entitlements in Queensland, click here. For those of you who don’t care about what has happened in the past but care more about what the QUT professors have recommended as the solution to the lot entitlements problem, then read on.

Remember this is not government policy. This report is QUT framing the feedback they have received into a recommendation for legislative reform. What now happens with it is up to the government.

Playing around with how levies are apportioned in a building produces what we think are the most emotive arguments in strata. There is nothing that divides lot owners quicker than when a group of owners’ levies go up and the beneficiaries are the owners whose levies have gone down.

We heard a whisper a while back that there was going to be something suggested that was a little outside the box. This discussion paper is that.

At the moment we have two schedules for lot entitlements. These are the contribution schedule and the interest schedule. Basically, the contribution schedule sets out an owner’s proportionate share of the body corporate levies.

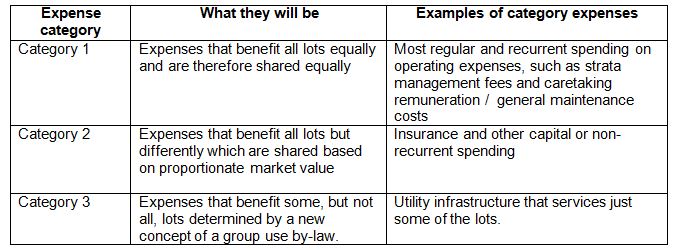

What is proposed is that the contribution expenses are moved into categories. These are:

If the law went this way, it would remove the need for a contribution schedule lot entitlement for new schemes. This is because category 1 costs are shared equally. The category 2 costs are then shared based on proportionate market value (the current interest schedule lot entitlements) or under a group use by-law for the category 3 costs (if any).

The paper suggests that anything that is not expressly nominated as a category 2 or 3 cost becomes a category 1 cost.

In theory, it makes a lot of sense. It also is far easier to implement in new buildings as opposed to existing ones with existing levies and cost apportionments.

Existing buildings would have a three-year window to transition to the new regime. The suggested process is:

- For the 12 months from the commencement of the amendments existing buildings would have the ability to seek expert evidence around what costs should fall into which categories;

- The building would then make a formal decision at its next AGM about what expenses fall where;

- That apportionment would kick in at the start of the next financial year after that AGM (which will be a relief to the strata management industry given some of the apportioning of levies required across levy periods last time).

If a building cannot agree on where the costs fall, there would be the right to apply to the Commissioner for an order.

If utility services are not separately metered for usage they will default to be category 1 expenses and shared equally.

So that’s the proposal. Whether it becomes law is something else.

The devil is always in the detail. What this absolutely will mean for existing buildings is Pandora’s Box will be opened. At a macro level there will no doubt be arguments about which expenses fall into which category. After that the arguments will be about categorisation of the actual expenses themselves. Was the actual spending a category 1 or category 2 expense?

There might need to be a review of the implications of consequential effects – for example, the group use by-law concept given that at present only exclusive use by-laws can impose a monetary liability. Other interesting questions are how group use by-laws will be created and what category one expenses will mean for subsidiary bodies corporate in layered schemes – especially if there are large differences in the respective number of lots between them.

For older mixed-use buildings the group use by-law (category 3) proposal will help. Commercial lots don’t use the pool or the gym. Residential lots don’t use the retail toilets or air conditioning. Being able to split these out other than through an arbitrary contribution schedule lot entitlement number makes sense.

Disclosure during the transition to would-be lot buyers will also be interesting. One of the arguments against changing entitlements is that ‘you knew what you were getting when you bought’. If a building is halfway through an adjustment, what gets disclosed?

Time will ultimately tell, but in the meantime, if it affects you, you should have your say. Remember – it is not law yet!

If you know anyone that needs to stay up to date with these things as they happen, make sure they sure sent this newsletter and asked to subscribe.